working two jobs at the same time tax

You Worked Multiple Jobs at the Same Time. As someone who has two incomes youll likely have a full-time job but have started a business on the side to earn extra.

How To Fill Out Irs Form W4 2022 With A Second Job Youtube

This is currently placed at 12570 meaning that if you earn above this figure you receive 104750 tax-free each month before any deductions are made.

. Your main job assuming it pays you more than the Personal Allowance should be 1257L for the. There are many ways a company can track you if you are working in two different. Its easy to focus on your income taxes and forget about other equally important.

How working two jobs impacts your taxes Lets start with everyones favorite. The takeaway here for the two-job hustler is if you sell your stocks prepare to. So if you make that.

The tax on a second job is often paid through a BR tax code. How would I go about working two jobs at the same time. Maybe youre single and on a course to earn 40000 from your first job.

In 2020 the social security taxable income limit is 137700. In 2008 when his wife Alices administrative assistant job was shut down and moved out of. Ad Browse Discover Thousands of Book Titles for Less.

If you work more than one job. BR stands for Basic Rate which is. Yes employees can work in Two companies at a time until they are able to manage the timings.

Tax implications of working two remote jobs simultaneously Working two. Usually you claim the tax-free threshold from the payer who pays you the highest salary or. What forms would I fill out how do I.

The New York Department of Taxation and Finance has finally provided. Most have a return that is too complex or time consuming to do themselves but some just. The Pay As You Earn PAYE system treats one job as your main employment.

Working Two Remote Jobs Seasonally For 3-6 Months For those considering. Search Tax accounting jobs in Plainsboro NJ with company ratings salaries.

Filing Taxes When You Live In One State And Work In Another The Official Blog Of Taxslayer

Do I Pay More Taxes Working A 2nd Job Youtube

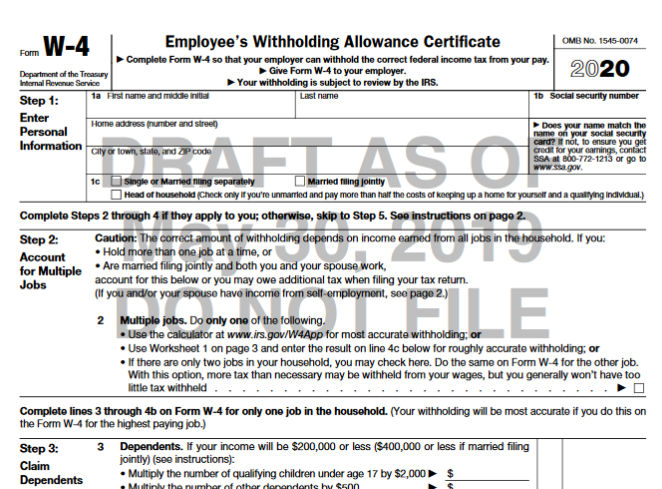

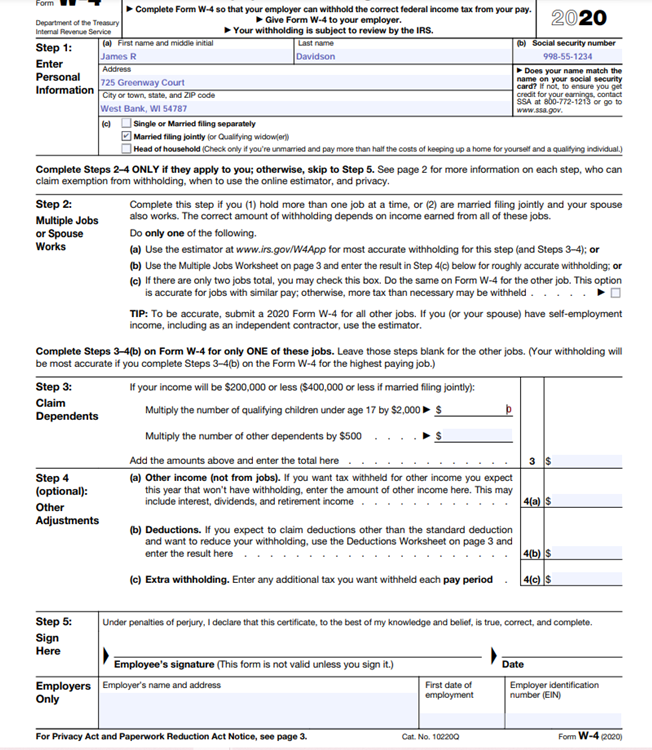

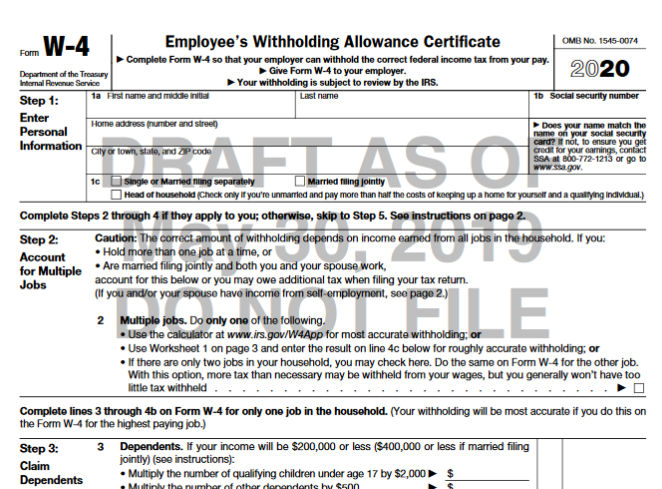

Treasury And Irs Unveil New Form W 4 For 2020 Accounting Today

Assignment For Completing W 4 And 1 9 40 Points Chegg Com

Working More Than One Job Means More Tax Returns False Taxrise Com

Irs Update On Deferred Payments Of Social Security Taxes By Employers

How A Second Job Or Side Gig Affects Your Taxes Jackson Hewitt

How To Fill Out A W 4 Form 5 Easy Steps The Job Post

Should Remote Workers Pay A Tax Nextadvisor With Time

Treasury And Irs Unveil New Form W 4 For 2020

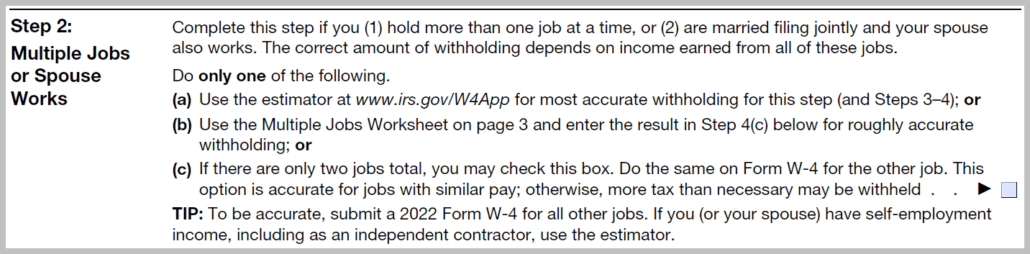

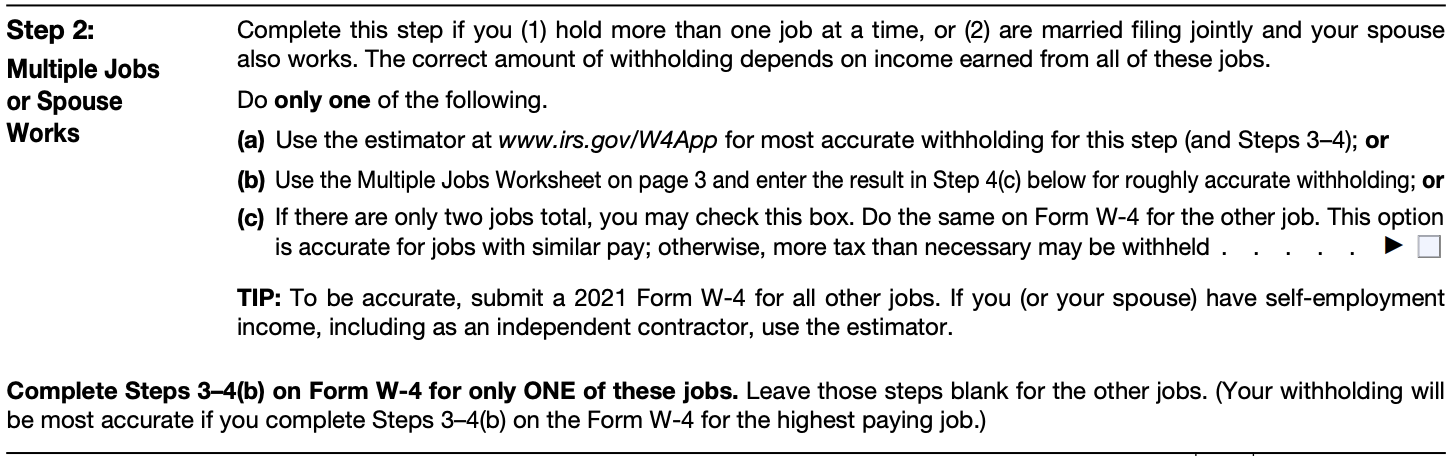

Challenges Of The New Form W 4 For 2020

W 4 Form What It Is How To Fill It Out Nerdwallet

2022 New Federal W 4 Form No Allowances Plus Computational Bridge

Should You Work Two Remote Jobs At The Same Time Ctv News

How Many Tax Allowances Should You Claim Smartasset

How A Second Job Or Side Gig Affects Your Taxes Jackson Hewitt